What is SAFESTOX?

SAFESTOX is our in house methodology that we use to create a curated set of Product offerings to our customers. SAFESTOX is highly selective on the value opportunities, which considers the below pillars for identifying the Financial Product:

provide a buffer in case of market adversities

Derivatives, Metals etc.

Hence, the above pillars ensure all products offered by INVULB are categorized and undergo a RATING.

INVULB follows a proprietary RATING system for the Financial Products distributed in our platform.

Accordingly these products are available in the individual PENSION PLANS and BASKETS (curated Financial Portfolio of Products) for the Investors to choose.

Based on the Basket Performance, their is a definition for valuation gap in financial returns/goals -REBALANCING for each type of Basket Structure and automated notifications are generated for customer actions such as

(new purchase) Add-more (to

existing investment)

or Hold

existing investment) Sell or

Redemption

Stock / MF / Financial Product will be given a rating of “A, B or C” indicating the below:

We will identify VALUE OPPORTUNITIES in the identified asset classes (Equity, MF, Gold, Derivatives etc)

- value for money

- undervalued

- substantially below the fair value

The following are the parameters considered for evaluating the specific Financial Products covered:

METALS: GOLD/SILVER

- Historical Value of Metal (Gold/Silver)

- Overall Global economic scenario

- Indian Macro economic scenario

- Inflation

- Interest Rates

- Currency Fluctuations

- international Metal prices etc.

MUTUAL FUNDS

- AMC performance - Fund Manager

- Strategy

- AUM

- Content

- Performance & Stability

- Historical and Peer analysis

- Governance etc.

STOCKS

- Management strength

- Governance standards

- Business partnerships & Industry position

- Government/Regulatory environment

- Stock market track record

- Financials/Valuation Ratios

- Stability of cash flow

- Growth prospects & Competition

- Investor Confidence

Bonds / Fixed-Income /Financial products:

- Issuer strength & track record

- Governance

- Financials

- Liquidity

- Credit rating

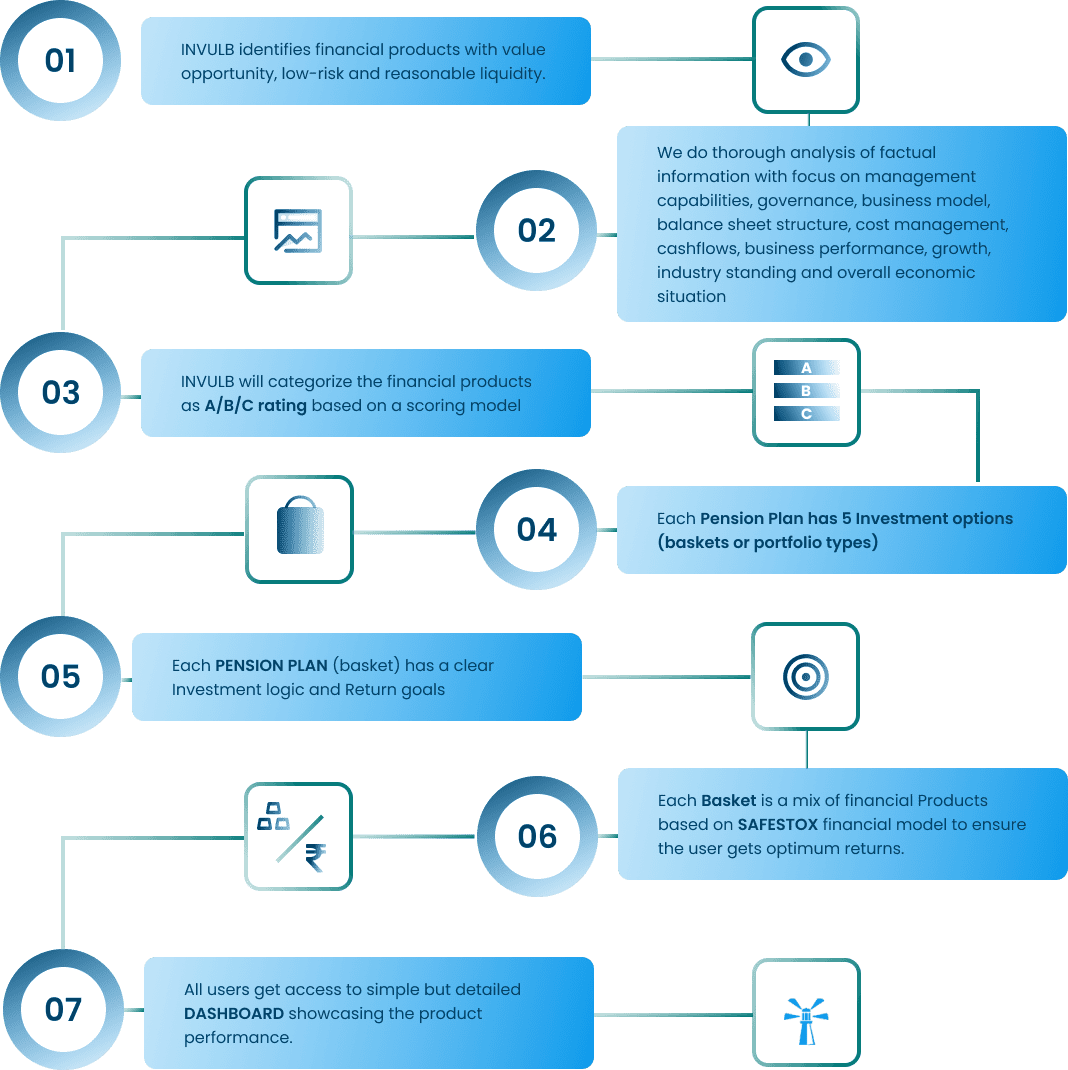

How does it work?

INVULB has used first of its kind Pension Product Basket (portfolio) based on INVULB product ratings-

Disclaimer

INVULB rating model is strictly meant for INVULB consumers who have signed up with the INVULB platform. Rating methodology

is based on the fundamental analysis of the following information available from - annual reports, official websites,

exchange filing and other reputed/authorized sources. Sources are reasonably verified by the INVULB analyst team,

and the analytical process is based on industry accepted common practices and logical projections.